Basics of Home Insurance, its Cover, Importance its Advantages

Imagine the peace of mind that comes from knowing that your most important investment is protected against unforeseeable circumstances. That piece of mind is precisely what home insurance provides. In this thorough tutorial, we’ll delve into the fundamentals of home insurance, examine its coverage, stress its significance, & lay out its many benefits.

A crucial element of responsible homeownership, home insurance offers financial security against a variety of perils that could befall your house. Having the appropriate house insurance coverage guarantees that you are well-prepared for any unforeseen circumstance, whether it involves damage from accidents, theft, or natural disasters.

Home insurance basics its relevance its cover

Home insurance is a sort of insurance that offers homeowners financial security against a variety of risks and harms to their homes. It is essential to protecting one of the biggest assets people ever make: their houses. The fundamentals of home insurance, its scope, and its significance are as follows:

One. Coverage

Typically, home insurance provides coverage in two key areas:

Property Coverage:

This feature of home insurance safeguards both your residence’s structure and its contents, which are your personal goods. When covered perils like fire, lightning, theft, vandalism, and certain natural disasters like windstorms cause damage or destruction, it offers compensation.

Liability Insurance:

Liability insurance safeguards your finances in the event that you are held liable for someone else’s injuries or property damage sustained while on your premises. For example, a visitor can slip and get hurt while visiting your home, or you might unintentionally damage a neighbor’s property.

Home insurance is crucial for a number of reasons, including:

Homeowners should protect their most valued possession, their home. If your house is damaged by one of the events covered by your home insurance, it will assist you in repairing or rebuilding it, minimising your financial burden.

Your personal possessions, including furniture, electronics, clothing, and more, are covered by your home insurance. Your insurance may be able to help you replace them if they are lost, damaged, or destroyed.

Liability Insurance:

Accidents do happen, and if someone gets hurt while visiting your property, you may be responsible for covering their medical bills and defence costs. Liability insurance enables you to control these costs.

Mortgage Requirement:

Your lender may require you to carry home insurance if you have a mortgage on your residence. In the event that the property is damaged, this will safeguard their investment.

Peace of Mind:

You may get peace of mind knowing that you are financially protected against unforeseen disasters. Without always thinking about potential threats, you can concentrate on enjoying your property.

Home insurance coverage come in a variety of shapes and sizes, including:

The most typical type, the HO-3 Policy, provides extensive coverage for both your home’s structure and personal property. All risks except those clearly mentioned as excluded are normally covered.

HO-4 Policy:

Also known as renter’s insurance, this policy covers renters’ possessions but excludes coverage for the building’s physical construction.

The HO-6 Policy, intended for condo owners, covers personal property as well as the interior design of the unit.

HO-8 Guidelines:

This policy, designed for older residences, pays the market value of the house rather than its replacement cost.

ALSO READ: How to make Rangoli’s top 10 easiest rangoli designs

advantages of Indian home insurance

In India, home insurance offers homeowners a number of significant advantages, including financial security and peace of mind in the face of several hazards and uncertainties. Here are a few of the main advantages:

Property Damage Coverage:

Your home is protected from a variety of dangers by home insurance, such as fire, lightning, storms, earthquakes, and floods. The insurance provider will assist with the costs of repairs or replacement if your house or possessions are harmed as a result of one of these risks thanks to this coverage.

Protection Against Burglary and Theft:

Home insurance offers protection against losses brought on by theft, vandalism, or burglary. If your house is broken into and your possessions are destroy or stolen, the insurance might be able to assist you pay for your losses.

Personal liability coverage is frequently include in homeowner’s insurance. This implies that the insurance can pay for medical costs and legal fees if someone is hurt while on your property, shielding you from potential litigation.

Temporary Living Expenses:

If your home is render uninhabitable as a result of covered damages, your homeowners insurance may pay for the cost of a hotel room, food, and other relate expenditures while your house is being restore.

Coverage for Natural Disasters:

Depending on the policy, house insurance may provide protection against calamities like landslides, floods, and earthquakes. These occurrences might result in significant property damage, making insurance coverage important for recovery.

Customizable Coverage:

Depending on their needs, homeowners can frequently select from a number of different types of coverage. This enables you to customise your policy to cover particular risks that are more pertinent to your setting and situation.

Financial stability:

By offering compensation for losses or damages that could otherwise need hefty out-of-pocket costs, home insurance offers financial stability. This can aid in your quicker recovery and prevent major financial setbacks.

Lender Requirements:

Your lender may stipulate that you have home insurance in order to receive a loan if you have a mortgage on your residence.

Peace of Mind:

You may feel more at ease knowing that your house and possessions are insure. Knowing that you have a backup plan in case something unforeseen occurs allows you to sleep better.

Affordable Premiums:

In comparison to the possible expenditures of repairing or rebuilding your home and possessions, home insurance premiums are typically inexpensive. It’s an affordable method to protect your investment.

Having home insurance can be a crucial step in safeguarding your property and your financial security in a nation like India where numerous natural disasters and other threats are common. To make sure you’re getting the protection you need, it’s crucial to thoroughly evaluate the terms of your policy and your options for coverage.

ALSO READ: How to track call | Top 10 call tracking software in india

a necessity for home insurance

Due to a number of important factors, homeowners should consider getting home insurance:

Home insurance protects your property against a variety of dangers, including fire, theft, vandalism, and natural catastrophes. It ensures that you won’t have to shoulder the entire financial burden alone by providing financial coverage to restore or replace your home and its belongings.

Home insurance provides liability protection in addition to property protection. This means that if someone is hurt while on your property, the insurance will pay for their medical bills and defence fees if you are found to be at fault. It shields you from potential legal action and the costs involved.

Owning a home gives you a sense of comfort and security. Home insurance gives you peace of mind, which improves this sensation. You are confident that even if the worst occurs, you will be able to handle the consequences financially.

Natural catastrophes:

Severe property damage can be brought on by natural catastrophes including earthquakes, floods, hurricanes, and tornadoes. You can recover from these terrible disasters with the aid of home insurance, which would otherwise put a lot of strain on your finances.

Content Coverage:

Home insurance extends to your personal property in addition to the building itself. If you own priceless stuff like electronics, jewellery, or collectibles, this is extremely important.

Temporary Living Expenses:

If a covered occurrence renders your home uninhabitable, your home insurance may be able to pay for your temporary living costs, including hotel stays and meals while your home is being restore.

Home insurance policies can be modified to meet your individual requirements. To fit your needs and budget, you can alter your policy’s coverage levels, add endorsements, and make other changes.

Financial safety:

Unexpected occurrences might cause serious financial setbacks. By purchasing home insurance, you may rest easy knowing that you are cover in case you need to pay for repairs, replacements, or legal troubles.

Community Requirements:

In some circumstances, residents of particular neighbourhoods or communities may need to have particular insurance coverage because of rules in the region or potential dangers.

ALSO READ: IRDA Ranking of Health Insurance Companies in India 2023

benefits of having house insurance

Numerous benefits of having home insurance include financial loss protection and comfort of mind. The following are some major benefits of obtaining home insurance:

Property Protection: Your home and its contents are cover by home insurance against a variety of dangers, including fire, theft, vandalism, and natural disasters. In the event of damage or loss, it guarantees that you can repair or replace your property.

Home insurance includes liability coverage, which guards you in the event that someone is hurt on your home or if you unintentionally damage someone else’s property. It includes potential settlements as well as court costs.

Financial stability:

The cost of restoring or rebuilding your home can be high in the event of a big calamity, like a fire or a powerful storm. Home insurance offers financial assistance so that you can recover from such unforeseen disasters without having to pay exorbitant sums of money.

Temporary Living Expenses:

If a cover loss renders your home uninhabitable, your home insurance may be able to pay for your interim living costs, such as hotel or rental fees, while your house is being restore or rebuilt.

Personal things Coverage:

In addition to the physical structure of your home, home insurance also provides coverage for your things, including furniture, gadgets, clothing, and appliances.

Mortgage Requirement:

Your lender will probably insist that you carry home insurance if you have a mortgage on your residence. This is done so that the lender can make sure that their investment is safeguard in the event of any unanticipat circumstances.

Peace of Mind:

Being confident in your insurance coverage can provide you peace of mind so you can enjoy your house without worrying about potential financial losses all the time.

Legal Defence:

If you are sued for injuries sustain on your property or property damage, home insurance may provide legal defence by paying for your defence costs.

Additional Coverage Options:

Depending on the policy and provider, you may have access to extra options for protection against identity theft, water damage, and other things.

benefits and drawbacks of property

Property ownership benefits

Property has the potential to increase in value over time, which could result in capital gains if you ever decide to sell it.

Equity Building:

You accrue equity in the home with each mortgage payment, which can be a valuable asset.

Rent:

If you decide to rent out the property, you’ll be able to generate income passively by renting out the space on a regular basis.

Owning a home can provide you a sense of security and stability because you have control over your living arrangements and don’t have to worry about landlords making unforeseen adjustments.

Tax Benefits:

Owning real estate frequently entails tax benefits, such as deductions for mortgage interest, property taxes, and other costs associated with property management.

Control and Personalization:

As a property owner, you are free to make changes and enhancements to the home that suit your tastes.

Possibility of Borrowing:

Owning property increases your borrowing potential because you can use it as collateral for loans or credit lines.

The drawbacks of property ownership include:

Initial Costs:

Purchasing real estate entails hefty up-front charges, such as down payments, closing costs, and maybe rehabilitation costs.

Property owners are responsible for doing maintenance and repairs, which can be expensive and time-consuming.

Property is not a liquid asset, and selling it may take some time and be impact by market conditions.

Market fluctuations might affect the value of your investment because property values can go up as well as down.

Property taxes are a requirement for home owners to pay and might affect your overall spending because they tend to rise over time.

Limited Mobility:

Owning property restricts your options for where you can live and is therefore less suited for people who need a degree of mobility.

Risk of Vacancy:

If you are renting out the home, there is a chance that there may be times when nothing is rent out, which could mean lost rental income.

Legal and Regulatory Issues: Owning property entails abiding by municipal ordinances, zoning restrictions, and the possibility of legal issues with renters or neighbours.

defining home insurance

Home insurance, commonly referred to as homeowners insurance, is a kind of insurance policy that offers coverage and financial security for a person’s house and belongings in the case of a variety of unforeseeable events. This insurance aids property owners in minimising potential monetary losses resulting from damage to their home or possessions brought on by occurrences like fires, theft, vandalism, storms, or other covered dangers.

A home insurance coverage normally consists of two key parts:

The physical structure of your house, such as the walls, roof, foundation, floors, and built-in appliances, is cover by the policy’s dwelling coverage. When a covered catastrophe, like a fire or severe weather, damages your house, the insurance provider will contribute to the expenses of repairs or rebuilding your home up to the policy limits.

Personal Property Coverage:

This section of the insurance plan provides coverage for your household possessions, including furniture, electronics, clothing, and other goods.

Home insurance policies may additionally cover the following additional items in addition to these essential ones:

Liability protection:

This takes care of any court costs and settlement negotiations in the event that someone is hurt on your property and sues you for compensation.

Additional Living Expenses (ALE) Coverage:

In the event that a covered occurrence renders your home uninhabitable, ALE coverage assists in defraying the cost of interim lodging and living expenses.

It’s crucial to remember that not all occurrences are protect by a typical house insurance policy. Earthquakes, floods, and normal wear and tear are a few frequent exclusions. To protect themselves against these particular hazards, homeowners can frequently get supplemental insurance or different policies.

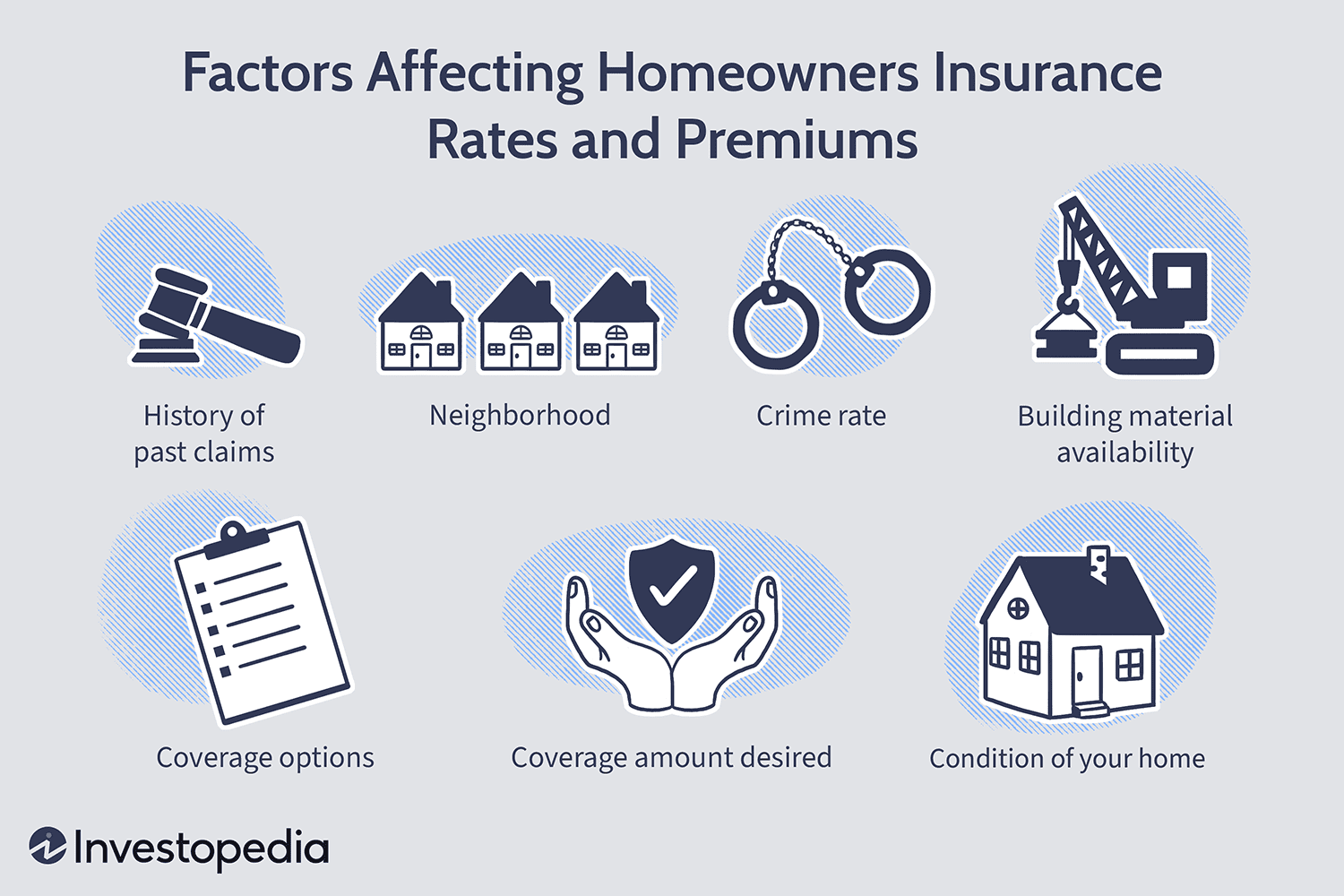

The coverage limitations, deductibles, and prices of home insurance policies can all differ. Your personal risk profile, the location and value of your house, the type of coverage you select, and other factors will all affect how much your premium will cost.

what is Indian homeowner’s insurance

Indian homeowners can purchase a home insurance policy to guard against financial losses brought on by hazards and damages to their residential property. It provides coverage for a variety of events, including theft, accidents, and natural catastrophes. The following are some essentials about home insurance in India:

Home insurance often provides coverage for both the building and the possessions of your home. Damages brought on by calamities like fire, lightning, earthquakes, floods, storms, and more are covered by the structure coverage. Your home’s goods and possessions, including as your furniture, appliances, gadgets, and personal items, are protect by content coverage.

Home insurance coverage in India often fall into one of two categories:

The actual structure of the home, including the walls, roof, floors, and built-in fixtures, is cover by this insurance.

Contents insurance:

This protects the household’s belongings, including furniture, electronics, clothing, and personal effects.

Home insurance premiums are determine by a number of variables, including the property’s value, the kind of coverage you select, where your house is locate, and the security measures you have in place. Generally speaking, higher rates might result from riskier places and greater coverage.

Home insurance has some exclusions, just like any other insurance coverage. Wear and tear, progressive degradation, and purposeful harm are examples of frequent exclusions.

Documentation:

You must submit proof of your property’s ownership and value when applying for house insurance. Documents pertaining to the property, a valuation report, and information on the home’s construction may be include.

Claim Procedure:

You must notify your insurance company & start the claims procedure in the case of damage or loss. This typically entails providing evidence of the damage, such as photos, as well as an estimate of the cost of repair or replacement.

Home insurance is crucial because it offers protection against unforeseen circumstances that could result in large financial constraints. Having house insurance can be a prudent investment to protect your property and assets in a country like India that is vulnerable to several natural calamities.

Government measures:

To encourage more homeowners to secure their properties, the Indian government has recently initiated measures to raise awareness of home insurance, particularly in disaster-prone areas.

Before selecting the policy that best satisfies your needs & circumstances, it is crucial to carefully evaluate several policies & their terms. For a complete understanding of the coverage, exclusions, & claim processes, always read the policy materials carefully.

benefits of home insurance in Hindi

Homeowners can benefit from a number of advantages from having home insurance, including financial security and peace of mind in the event of certain hazards and unanticipated occurrences. Some significant advantages of home insurance include:

Property Damage Coverage:

Home insurance offers protection for harm to your house and its belongings brought on by a variety of covered perils, including fire, lightning, windstorms, and more. With the aid of this coverage, you can replace damaged property and repair or rebuild your home.

Your personal items, including furniture, gadgets, clothing, and other valuables, are cover by your home insurance.

Additional Living Expenses:

If your home is render uninhabitable as a result of a cover occurrence, your insurance plan may be able to assist in paying for temporary living costs like hotel stays and meals while your house is being repaire or rebuilt.

Natural catastrophes:

Your house insurance may offer coverage for certain natural disasters like earthquakes, floods, and hurricanes depending on your policy and area.

Loss of Use:

If a cover occurrence prevents you from living in your home, your home insurance may be able to cover the additional costs of finding another place to live while yours is being repaire.

Medical Payments:

Whether or not you are at fault, this coverage aids in cover medical costs if a visitor is hurt while on your premises.

Personal Liability:

If you are sue for causing accidental bodily harm or property damage to others, your home insurance may provide defence costs and damages coverage.

Coverage for Detached Structures:

Your house insurance policy may also provide coverage for detached structures on your property, such as garages, sheds, and fences.

Peace of Mind:

The peace of mind that house insurance offers is among its most important advantages. recognising your financial security against unexpected events can offer reassurance to homeowners.

A thorough study of your house insurance policy is necessary to comprehend the exact coverage it offers and any exceptions. Make sure you purchase a policy that meets your needs and provides the protection you require because different policies and insurance companies might offer differing levels of coverage.

YOUTUBE: Basics of Home Insurance, its Cover, Importance its Advantages

FAQs

Home insurance is a form of insurance coverage create to shield homeowners from monetary losses brought on by losses to their property or possessions as a result of covered occurrences like fire, theft, or natural catastrophes.

Home insurance often covers the physical structure of your house, your possessions, liability for accidents or property damage to others, and additional living costs in the event that a covered catastrophe renders your house uninhabitable.

Insurance for your home protects you financially from unforeseen circumstances that could result in substantial losses. Knowing they have a safety net in case of emergencies provides homeowners piece of mind.

Home insurance benefits include financial security against unforeseen losses, coverage for repairs or replacements, defence against liability lawsuits, and support with interim living costs while the house is being fixe.

Fire, theft, vandalism, hail, lightning, windstorms, and some natural disasters are typical incidents cover. Depending on the area and the policy, coverage may change.

Additional FAQs

Floods, earthquakes, normal wear and tear, intentional damage, and some forms of negligence are typically not cover by home insurance.

The price, or premium, depends on a number of variables. Including the home’s location, value, level of coverage, deductible amount, and claim history of the homeowner.

The amount you consent to fork up before your insurance coverage begins is know as a deductible. Lower premiums are typically the outcome of higher deductibles.

Investigate and contrast various insurance companies, plans, limits of coverage, and deductibles. When choosing a choice, take into account the worth of your property, its location, and your own demands.

In most cases, you can update your coverage as your needs change. Every year, you should examine your policy and, if required, make revisions.

Additional FAQs

If you’re proven legally liable for someone else’s injuries or property damage. Both on and off your property, liability coverage will protect you financially.

Home insurance is frequently not require by law, in contrast to mortgage lenders who do. However, safeguarding your money is highly advise.

In the event of a covered loss, get in touch with your insurance company right. Away to begin the claims procedure. Describe the occurrence in detail and provide any supporting documentation.

Yes, tenants are eligible to get renter’s insurance. It does not protect the property’s structure, only liabilities and personal goods.

When paying out for damaged or stolen goods, actual cash value takes depreciation into consideration. Without taking depreciation into account, replacement cost coverage covers the cost of replacing goods with new ones.

Conclusion

In order to protect their investment & possessions, homeowners must understand the fundamentals of home insurance. A complete safety net is offer by home insurance against unanticipated circumstances that can cause sizable financial losses. Its scope of coverage includes additional living expenditures during essential repairs. As well as coverage for the home’s structure, personal property, liabilities, & other costs. It is impossible to exaggerate the value of having home insurance. Since it gives homeowners security & peace of mind in the event of unforeseen disasters.

THANK YOU FOR VISITING OUR SITE: How to find the sim card owner in india